Us Tax Brackets 2025 Married Filing Jointly

Us Tax Brackets 2025 Married Filing Jointly. Find the 2025 tax rates. Generally, as your income increases, you’ll.

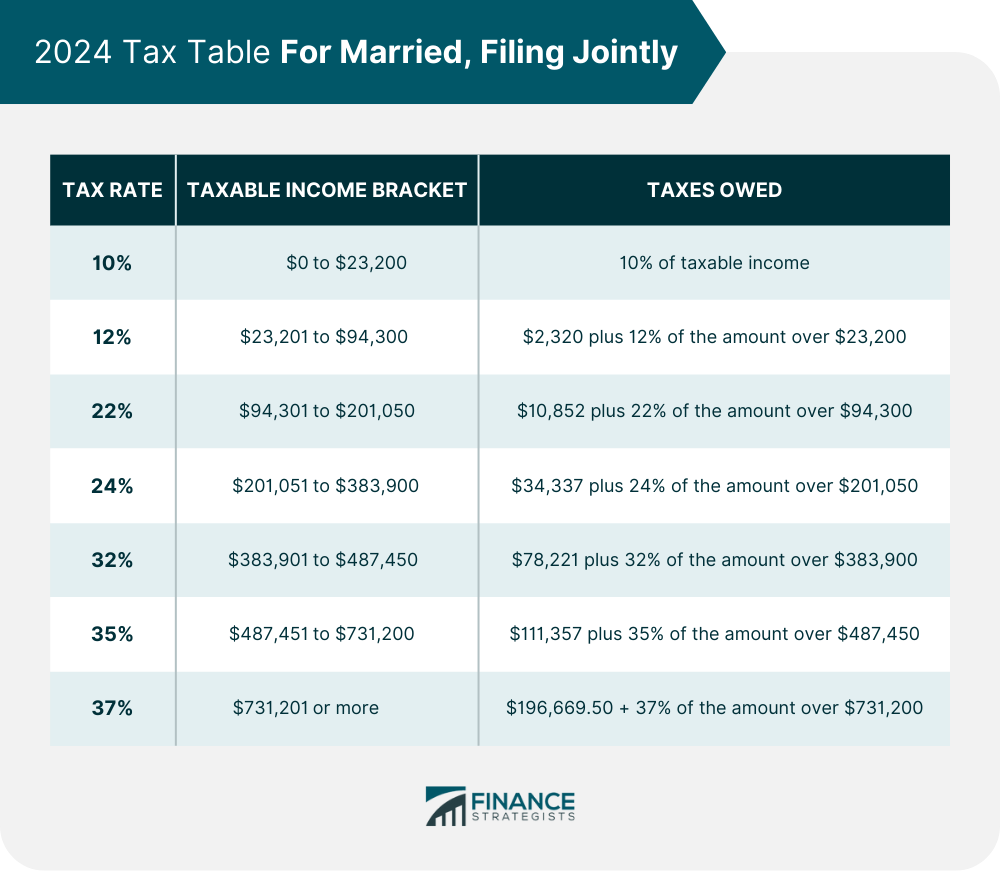

10%, 12%, 22%, 24%, 32%, 35%, and 37%. It’s important to note that these rates generally don’t change unless congress passes major tax legislation.

Us Tax Brackets 2025 Married Filing Jointly Images References :

Source: lilyvkyrstin.pages.dev

Source: lilyvkyrstin.pages.dev

Us Tax Brackets 2025 Married Jointly 2025 Cookie Marthe, Find the 2025 tax rates.

Source: adrianythomasin.pages.dev

Source: adrianythomasin.pages.dev

Tax Brackets 2025 Married Jointly Ppt Tiffi Adrienne, The income tax brackets for tax year 2025 have also been adjusted accordingly based on recent economic activity:

Source: gwenniyhildagard.pages.dev

Source: gwenniyhildagard.pages.dev

Irs 2025 Tax Brackets Married Filing Jointly Edie Lucine, In 2025, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1).

Source: wallyymadonna.pages.dev

Source: wallyymadonna.pages.dev

Us Tax Brackets 2025 Married Filing Jointly 2025 Dode Nadean, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.trustetc.com

Source: www.trustetc.com

2025 Tax Brackets Announced What’s Different?, The irs announced tax rates for its seven tax brackets for tax year 2025:

Source: cordeyballison.pages.dev

Source: cordeyballison.pages.dev

2025 Tax Brackets Married Filling Jointly Karla Marline, Your bracket depends on your taxable income and filing status.

Source: www.financestrategists.com

Source: www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2025 Rates, Here’s a breakdown of the tax rates you’ll need to pay in 2025, based on the income you earn in 2025:

Source: lottibmicaela.pages.dev

Source: lottibmicaela.pages.dev

2025 Tax Tables Married Filing Jointly Married Jointly Cher Melany, The standard deduction for married couples filing jointly for tax year 2025 rises to $29,200, an increase of $1,500 from tax year 2023.

Source: nettaqfleurette.pages.dev

Source: nettaqfleurette.pages.dev

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, Generally, as your income increases, you’ll.

Source: malaycharissa.pages.dev

Source: malaycharissa.pages.dev

Us Tax Brackets 2025 Married Couples Halley Griselda, The five filing statuses are:

Category: 2025